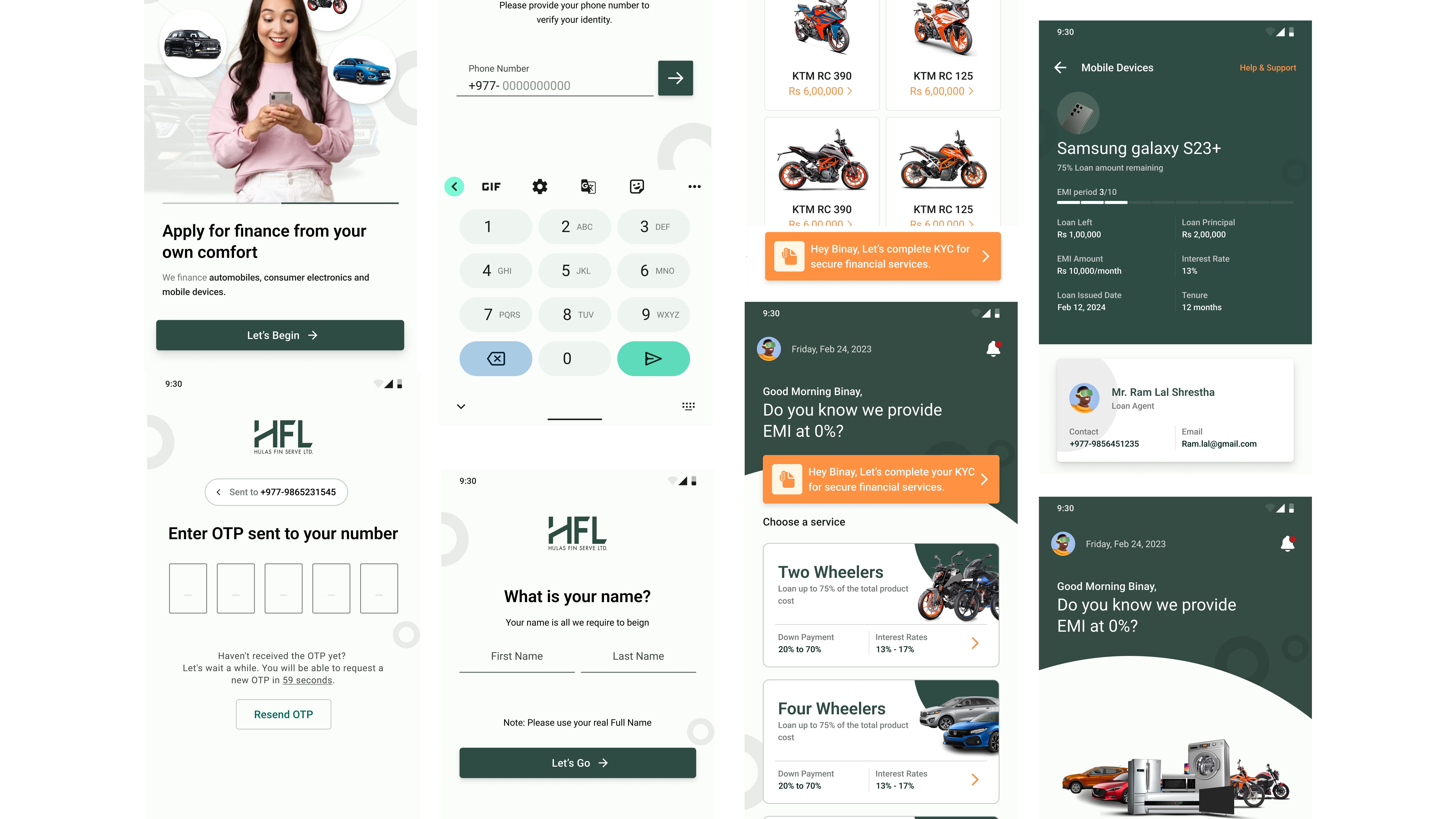

At Featherwebs, we take immense pride in collaborating with industry leaders to bring transformative digital solutions to life. Our partnership with Hulas Fin Serve Ltd. (HFL), a subsidiary of the esteemed Golchha Group, was driven by a shared vision—to simplify and enhance the financing experience for customers purchasing automobiles, mobile devices, and home appliances.

The Challenge

HFL’s financing model had served customers well, but as demand grew, so did the need for a faster, more accessible, and transparent digital platform. The existing system faced several challenges:

- Cumbersome manual processes made loan applications and approvals slow and inefficient.

- Lack of digital integration limited real-time access to financing options and status updates.

- User experience barriers made it difficult for customers to navigate financing procedures.

- Scalability concerns restricted growth and the ability to cater to a broader audience.

To address these challenges, HFL needed a modern, intuitive, and scalable digital financing solution.

Our Approach

At Featherwebs, we believe technology should make life easier. We set out to redefine the financing experience, ensuring HFL could offer customers a hassle-free, transparent, and efficient way to secure loans. Our approach focused on:

User-Centric Design – Crafting a seamless, intuitive interface for customers and administrators.

Process Automation – Eliminating manual inefficiencies through digital workflows and real-time approvals.

Integrated Financial Ecosystem – Connecting HFL’s financing system with banking APIs for smooth transactions.

Scalable & Secure Infrastructure – Building a platform capable of handling growing demand while ensuring data security.

The Solution

Our collaboration resulted in a cutting-edge digital financing platform that enables HFL customers to apply for and manage loans with ease and transparency. Key features include:

Instant Loan Application & Processing – Customers can apply for financing online without the hassle of paperwork.

Eligibility & Approval System – Smart algorithms assess eligibility and accelerate approvals.

Transparent & Flexible Financing Options – Financing covers up to 70% of the total budget, making vehicle ownership more accessible.

Real-Time Tracking & Notifications – Customers receive instant updates on their application status.

Secure Payment & Disbursement System – Ensuring smooth and safe transactions between customers and financial institutions.

The Impact

Our digital solution transformed HFL’s financing process, offering faster approvals, seamless loan management, and an enhanced user experience. The results speak for themselves:

80% Faster Processing Times – Reduced loan approval turnaround significantly.

Increased Customer Engagement – Higher satisfaction with the intuitive and hassle-free process.

Optimized Internal Workflows – Automation streamlined operations, reducing administrative workload.

Scalable & Future-Proofed System – Enabling HFL to expand its services efficiently.